Weekly Impressions: What the capex cliff reveals about Australia's 'big short'

/In the past week, two bottom up developments dominated the financial market news flow in Australia: the belated announcement of CEO succession at Woolworths and renewed concerns that Australian banks represent a 'big short' thanks to rumours of the imminent collapse of residential house prices. These two developments have more in common than meets the eye because they are revealing of the causes and consequences of corporate Australia's dormant animal spirits.

The elevation of Mr Brad Banducci as Woolworths' new CEO comes not long after the Chair, Mr Gordon Cairn, announced that the company would be exiting its home improvement business. Together with its joint venture partner, Lowe's, Woolworths has invested more than $3 billion in the Masters business and generated losses of around $1 billion in less than five years.

At the time of establishing the business in 2011, then newly appointed CEO, Mr Grant O'Brien, had made a compelling case for entering into the fragmented home improvement space, whose size then was estimated to be over $30 billion in revenue, which has since been revised up to over $40 billion. Surely the pie would be big enough to accommodate two big box hardware retailers?

Corporate Diversification: RIP

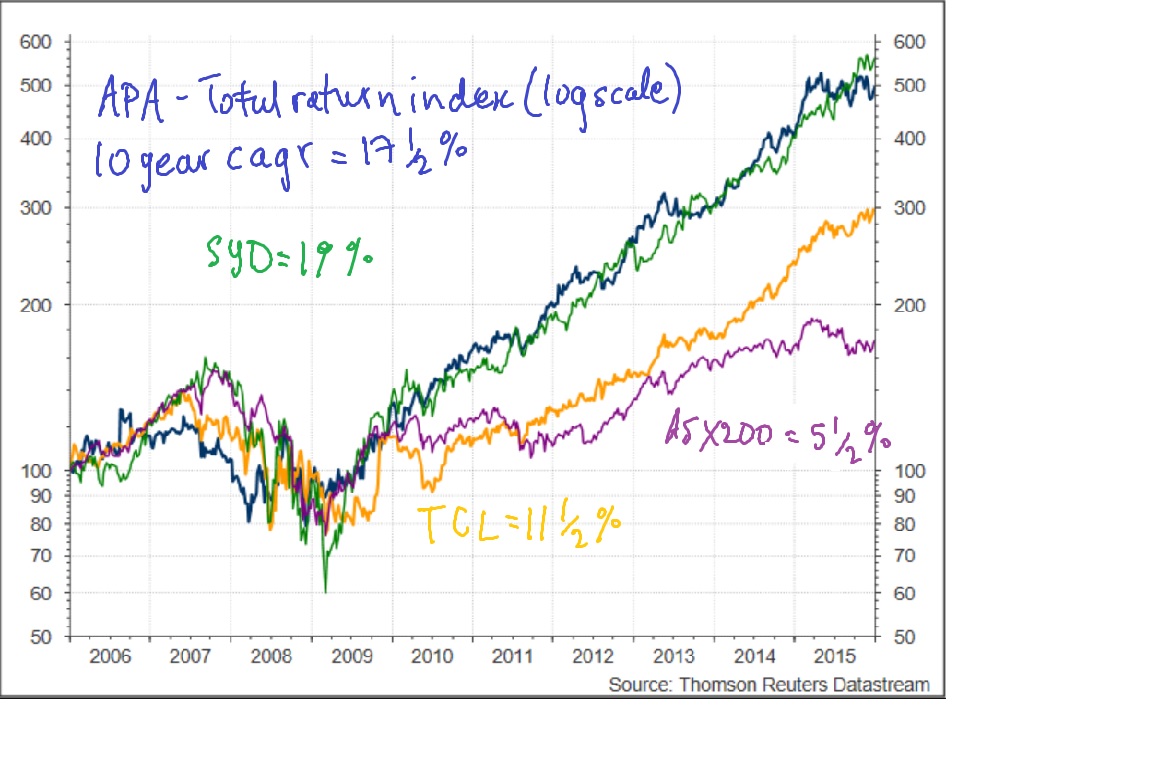

Woolworths effectively bucked the trend towards corporate clarity that has been a recurring theme in Australia and globally since the financial crisis, reflected in a wave of demergers and divestments. Diversified and globally dispersed business models have given way to more geographically and product focussed models, including BHP, Amcor, Brambles, Fosters, Orica, and more recently NAB and ANZ. By eschewing long held growth options that have failed to meet their cost of capital, Australian firms have effectively unlocked free cash flow which has been used to lift dividends, and recognised that investors can engage in DIY diversification at low cost, via passive open ended funds and closed end exchange traded funds.

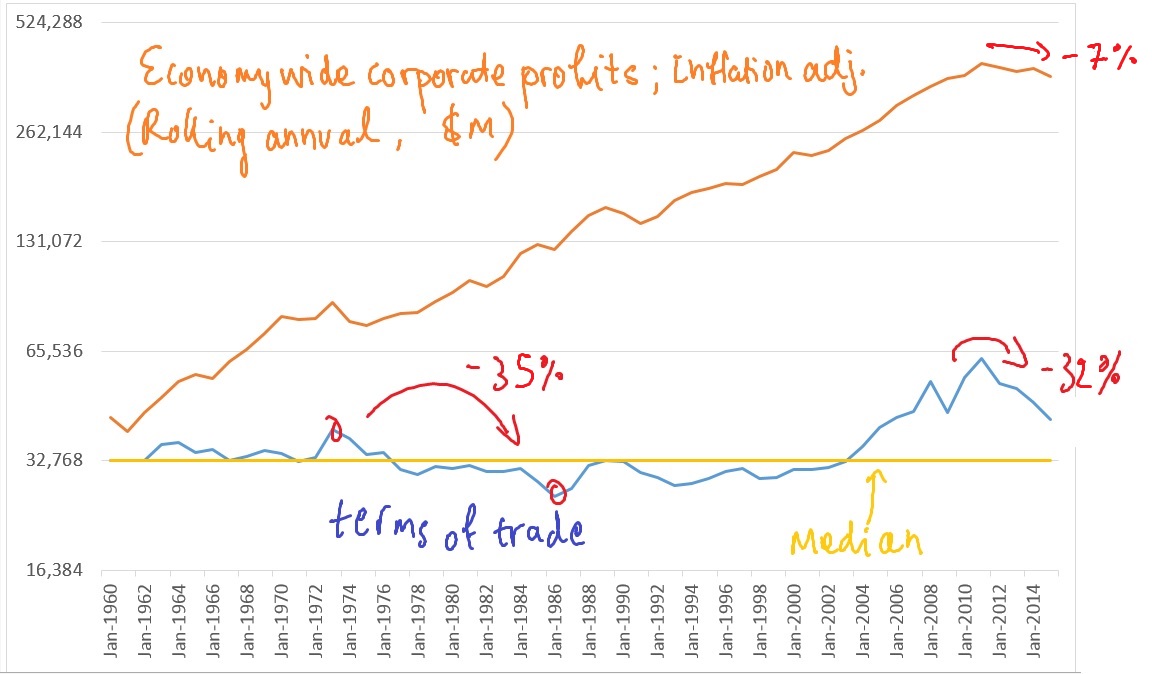

The decline in Australia's terms of trade by one-third from its peak five years ago has accelerated the trend towards corporate focus, as firms have sought to restructure, defer or abandon capital investment projects, and trim costs aggressively to combat strong revenue headwinds. The outcome has been impressive; profitability has declined by less than 10% over this period (see chart).

Australia's Imminent Capex Cliff

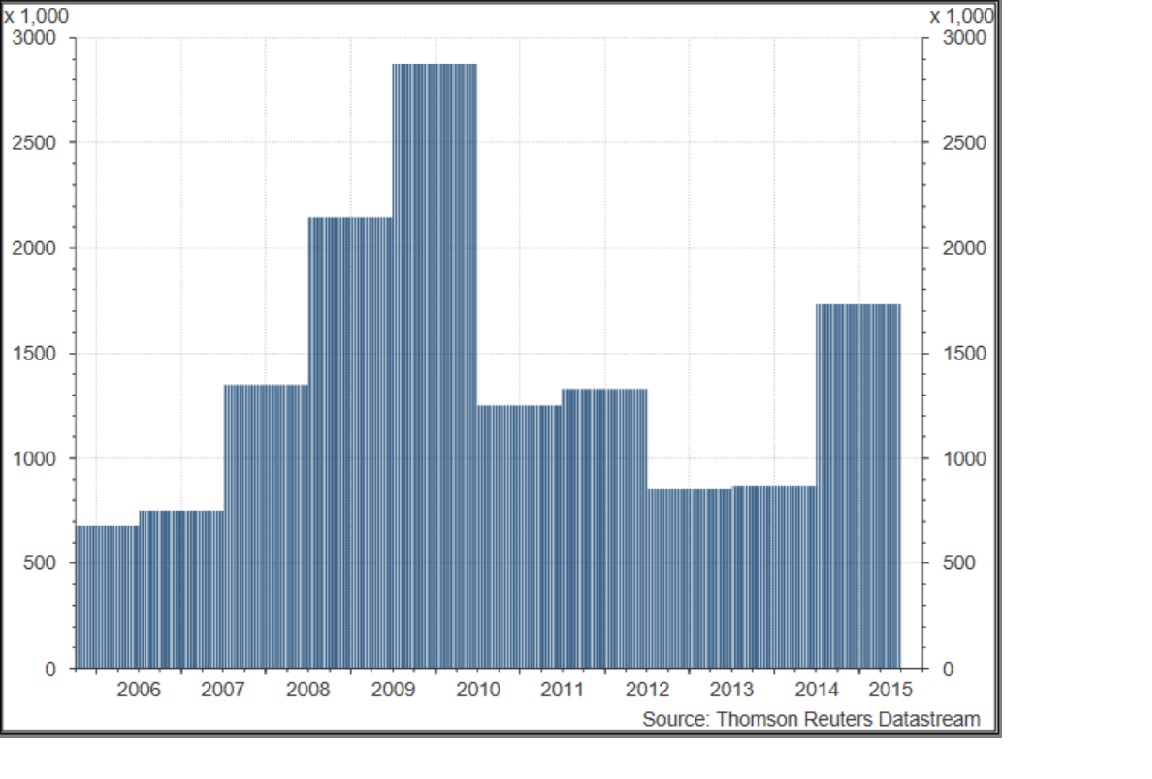

The thematic of dormant animal spirits in the corporate sector remains strong. During the week, the December quarter CAPEX data released by the ABS confirmed that firms continue to downsize their future capex plans. Each quarter, the ABS surveys a representative sample of firms across all industries who provide estimates for their capex spend in the current and next financial year.

For the December quarter data just released, firms provided their fifth quarterly estimate for FY16 and first quarterly estimate for FY17. The profile of capex intentions for FY16 most resembles those for FY11 (see chart). The first estimate for each of those two years both started at a little above $100 billion, with the fifth estimates (the most recent one for FY16), pointing to $125 - $130 billion. If the actual outcome for FY11 is any guide, total capex spend for FY16 will come in at around $120 billion (in nominal terms), which represents a shortfall of $30 billion or 20% from the previous year.

To put this is context, this would amount to the largest nominal percentage decline in business investment in over 25 years. During this time, the next largest decline occurred in Australia's last recession, where capex posted a 17% decline in 1992.

The preliminary estimate for FY17 of $83 billion points to further downside risk to the capex outlook beyond the current financial year. The chart below provides the first of seven quarterly estimates (blue columns) for each financial year as well as the final actual outcome (yellow columns). Typically, firms under-estimate their capex spend up to two financial years out, which is reflected in the fact that most of the yellow columns lie above their respective blue column. The initial estimate for FY17 is marginally below that of the initial estimate for FY10. If the actual outcome for that year is any guide, capex will come in at around $105 billion in FY17, around 12% lower than the implied outcome for FY16.

Where is Mr Stevens' Growth Plan?

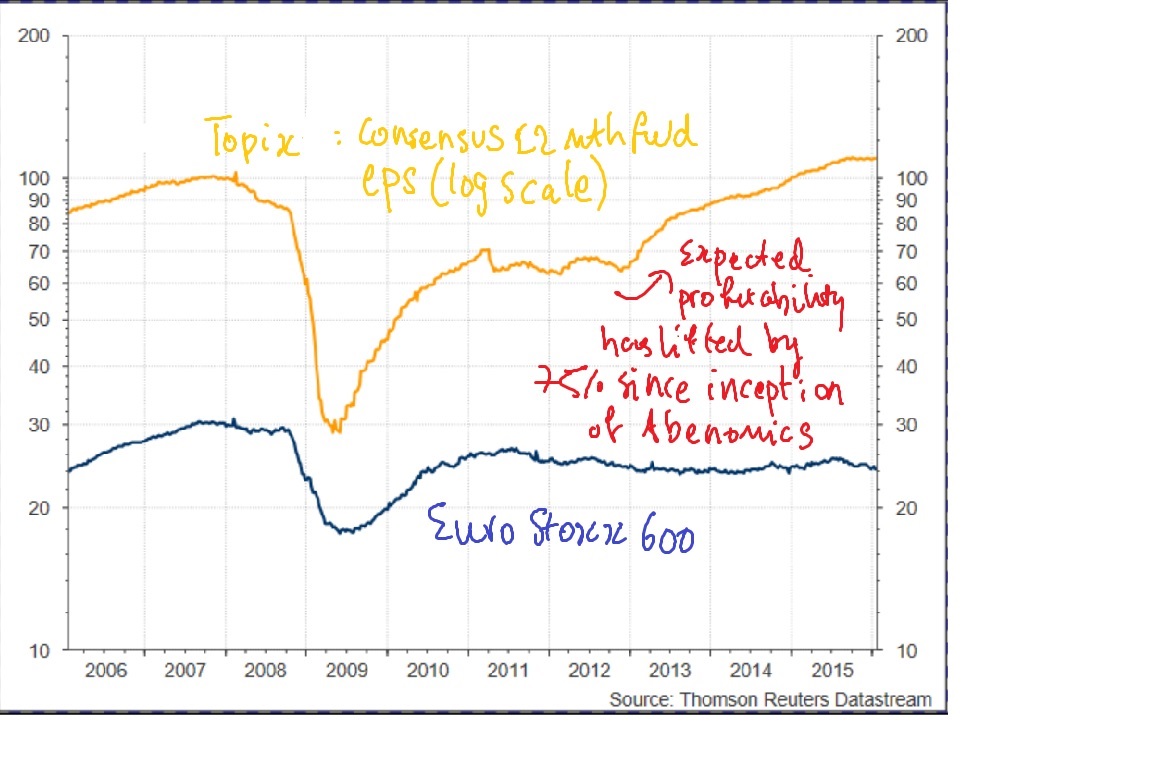

A drop in mining sector capex was to be expected after the end of the commodities boom. But contrary to the RBA's expectations, the non-mining sector has not stepped up to the plate, which has frustrated the central bank's efforts to re-balance economic growth. In the past, Mr Glenn Stevens, the RBA Governor, has asked rhetorically where corporate Australia's growth plan is, has bemoaned the lack of entrepreneurial risk taking and implored analysts and investors to encourage the companies they cover to invest for growth rather than focus on trimming costs.

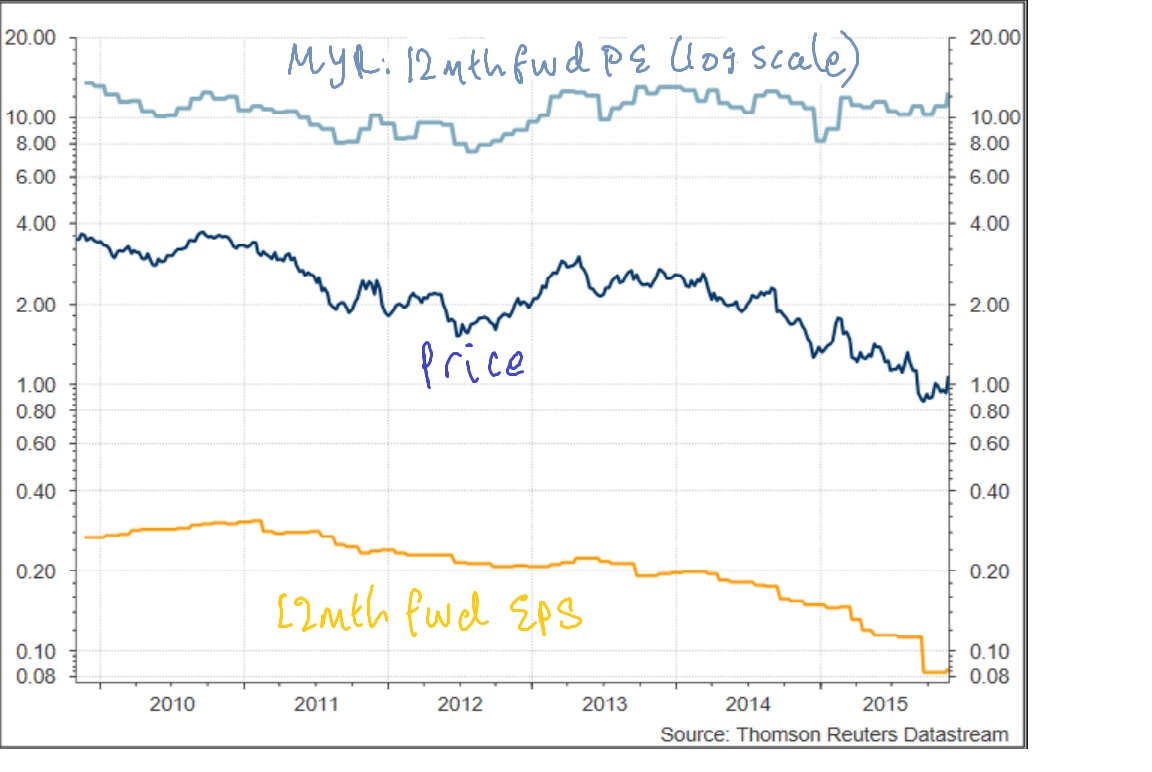

Woolworths' failed experiment in home improvement should offer the RBA a valuable data point why most of corporate Australia is reluctant to invest for growth, particularly at a time when the ABS release during the week showed that private sector wages grew by only 2% yoy in the December quarter, a new record low (see chart).

What the capex cliff means for Australia's big short

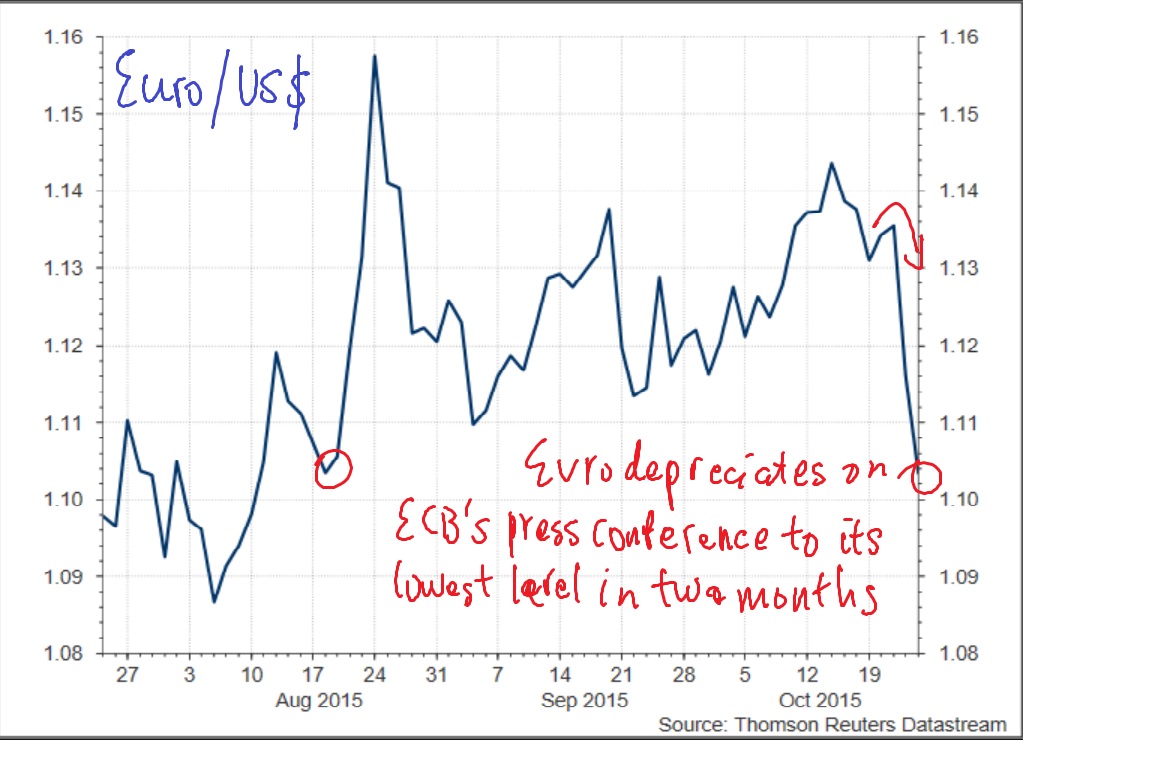

The reluctant rate cutter has had little choice but to deliver more monetary stimulus in recent years while the terms of trade have fallen by one-third and animal spirits in the corporate sector have remained dormant. The re-balancing of growth hasn't exactly gone to the RBA's script but there has been a re-balancing of growth away from mining investment towards dwelling investment, household consumption and net exports.

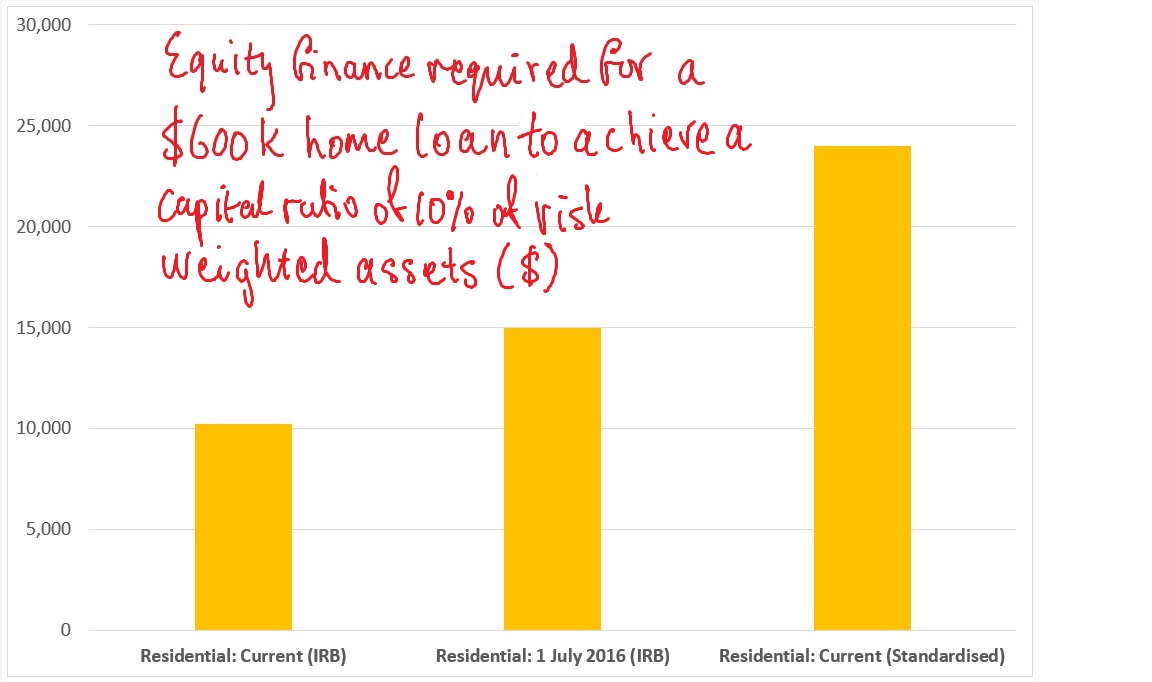

The RBA has felt that it is between a rock and a hard place; providing accommodative monetary settings given the shortfall in aggregate demand, but careful to ensure that multi-decade low interest rates do not stoke speculative activity in housing. The strong lift in house prices in Melbourne and particularly Sydney from 2012-15 caused the RBA and APRA enough concern to encourage banks to reduce growth in lending to housing investors and adopt more prudent lending standards.

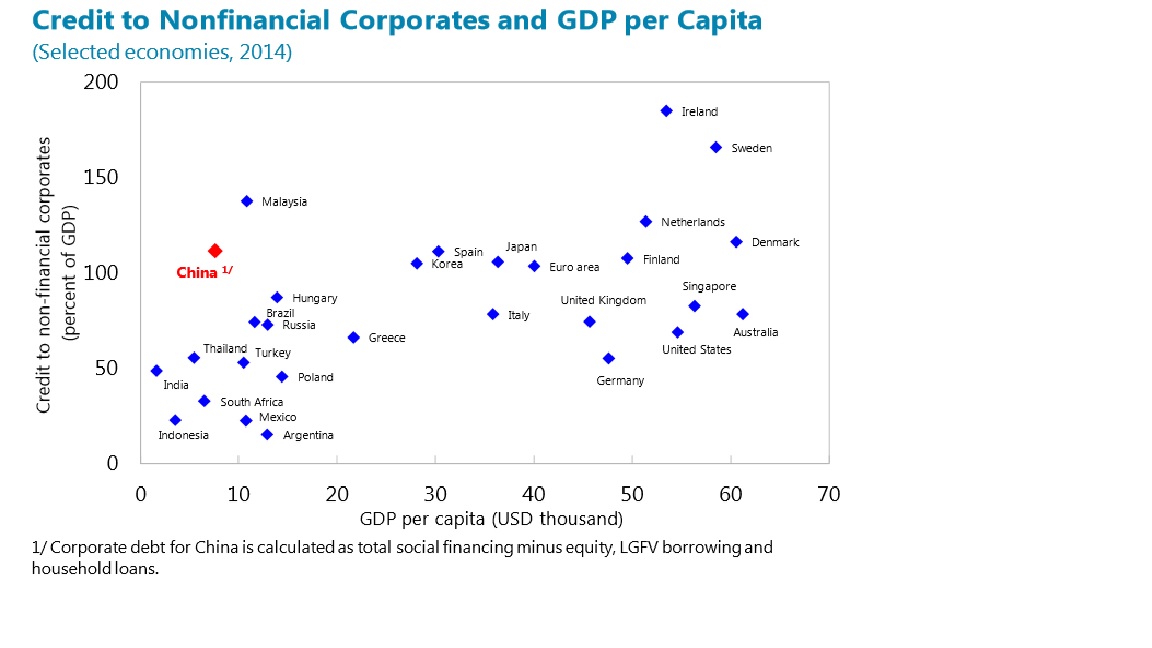

It is against this backdrop that the talk about Australian housing and the major banks representing the 'big short' has polarised opinion if the news flow is any guide. The quality of lending standards is a good starting point to gauge how widespread speculative activity is. But any talk of a bubble discounts the important role that dwelling investment still has to play to support the economy until a revival in the corporate sector's animal spirits emerges. The updated losses announced by Woolworths home improvement this week and decision to exit the sector altogether served as a timely and powerful signal to other corporates about the dangers associated with investing for growth in the current environment of deficient demand. If there is a bubble in Australian housing, it therefore might well persist for quite a bit longer.