Weekly Impressions: Investor appetite for infrastructure assets to remain strong

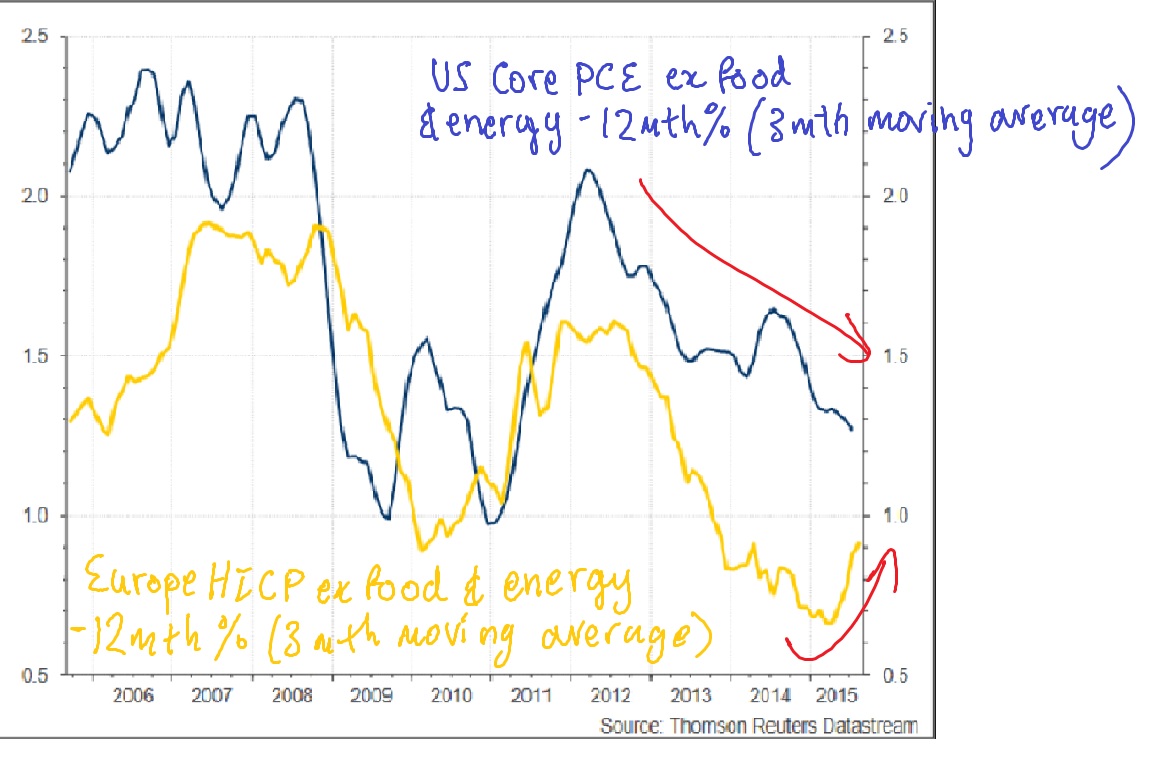

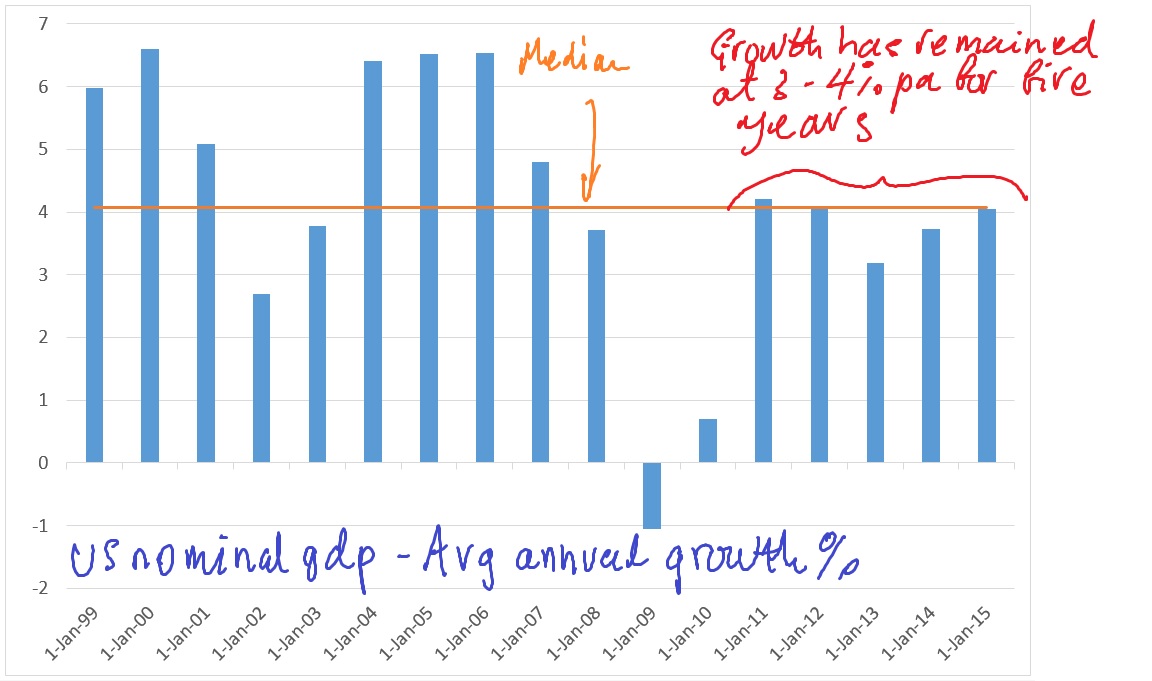

/In December, Evidente published a post which cited a speech from Governor Lael Brainard, in which she discussed the likely path for monetary policy normalisation, based on the framework of the neutral rate of interest. This is the federal funds rate that is consistent with output growing close to its potential rate with full employment and stable inflation. Tepid growth in the US economy and quiescent inflation suggests that the neutral rate is not far above the federal funds rate. Ms Brainard indicated that the neutral rate would remain low (possibly close to zero) for some time to come and concluded that the normalization of the federal funds rate is likely to follow a more gradual and shallower path than in previous tightening cycles; what Evidente depicts as the new normal of low and slow.

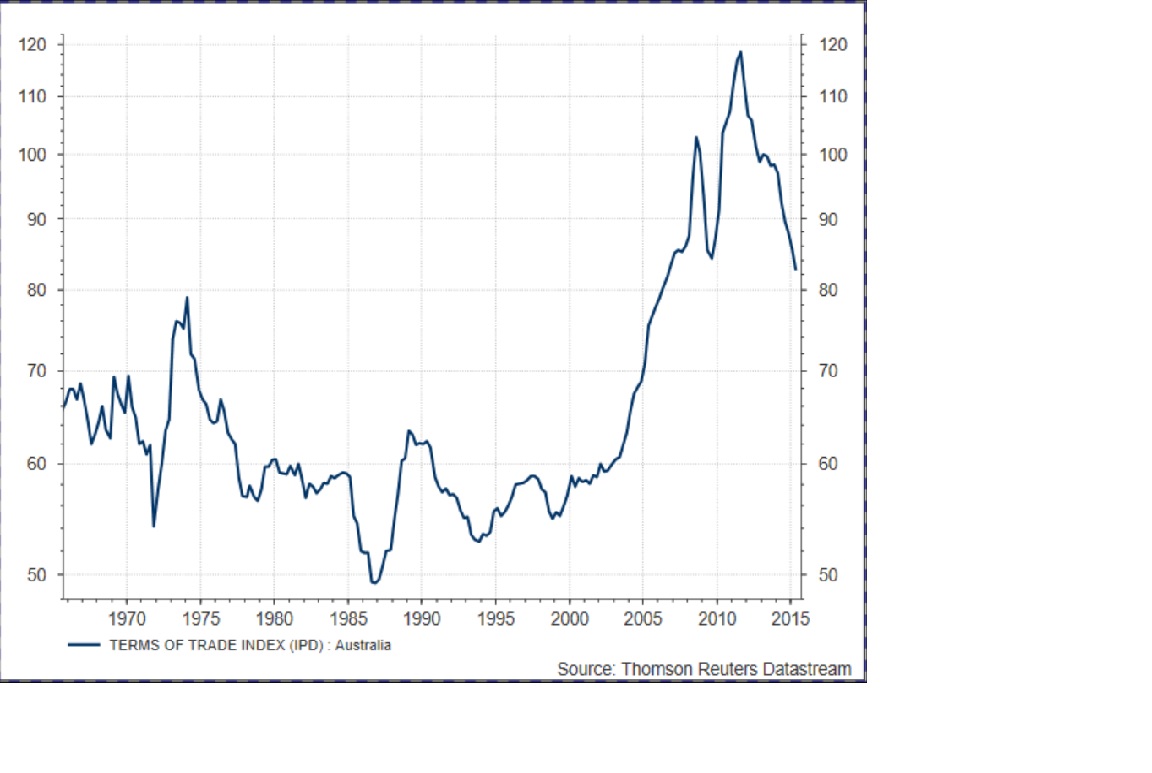

A recent speech from Vice Chairman Stanley Fischer suggests that the secular decline in the neutral rate of interest is guiding the Fed’s view and internal debate around policy normalization. Vice Chairman Fischer speculates that the world is moving toward a permanently lower long-run equilibrium real interest rate, consistent with the fall in the level of longer-term real rates observed in the United States and other countries (see chart).

A world with a permanently lower neutral interest rate thanks to structural shifts

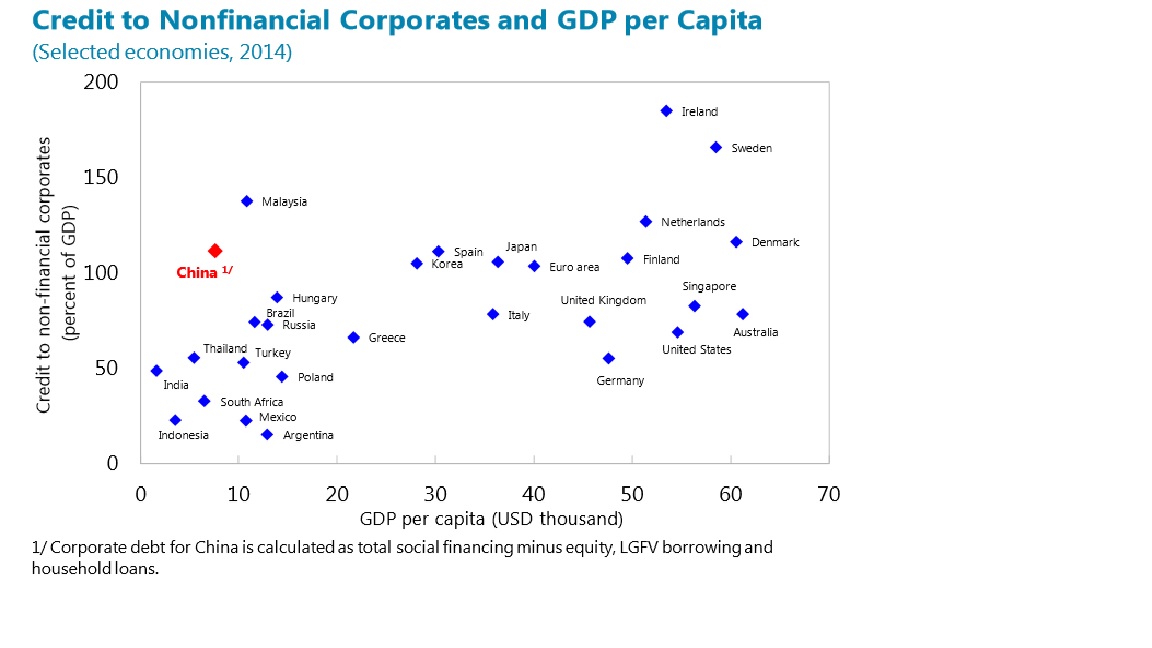

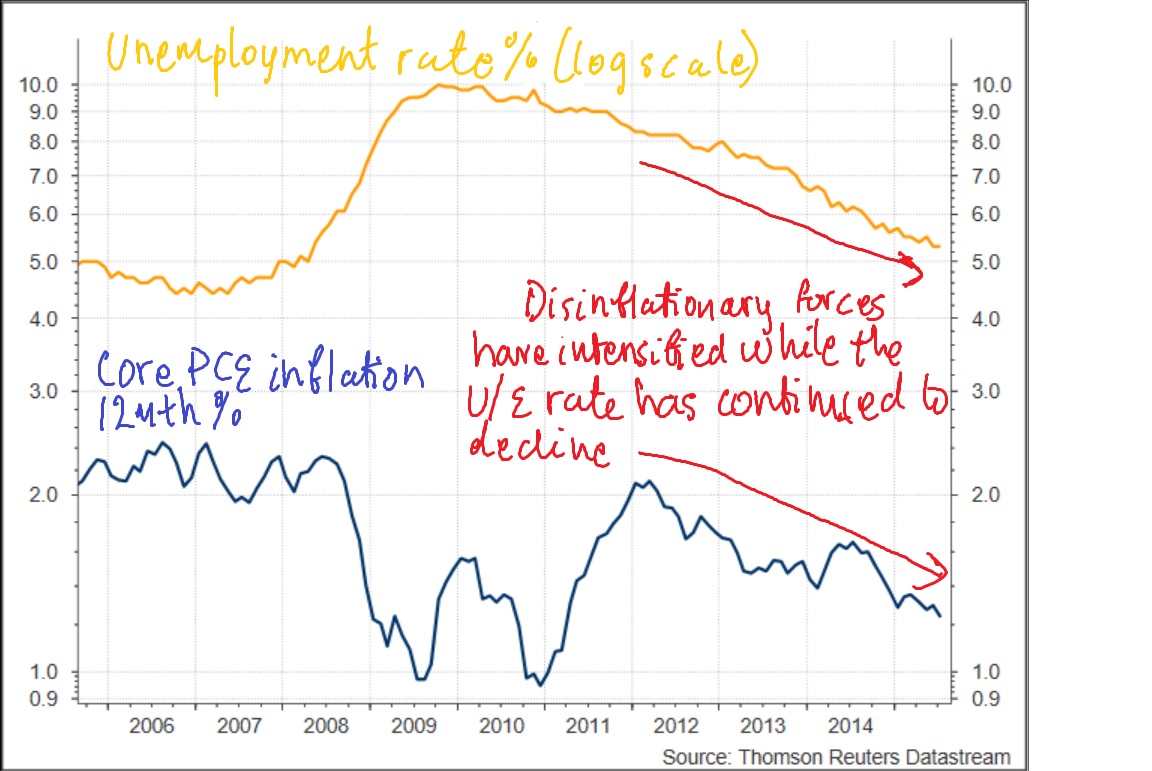

The balance between desired saving and investment intentions governs the neutral rate; a lift in intended saving over investment has led to a lower neutral rate in equilibrium. Vice Chairman Fischer cites a number of developments that have contributed to the shortfall in investment relative to saving: deficient aggregate demand since the financial crisis, the low capital intensity of the IT sector, a slowdown in productivity growth, the demographics of ageing, and high savings rates in emerging markets combined with a shortage of profitable investment opportunities in those countries.

In a supply-demand framework, the supply curve for saving is upward sloping because a higher interest rate is associated with greater supply of saving, while the downward sloping demand curve corresponds to investment demand. The developments cited by Fischer correspond to an outward shift of the supply curve and left shift in the demand curve, which produce a lower neutral rate in equilibrium (see chart).

To the extent that these structural shifts are long lasting, Fischer suggests this supports the case for the neutral rate remaining low for the policy relevant future. Consequently, it is likely that the zero lower bound will continue to constrain monetary policy at times. In other words, lift-off in December does not imply that the federal funds rate won’t return to zero in the foreseeable future. This represents a subtle hint from Fischer that growth in the US economy might remain tepid for some time and that inflation will remain low thanks to the long lasting powerful impact of excess desired saving over investment intentions.

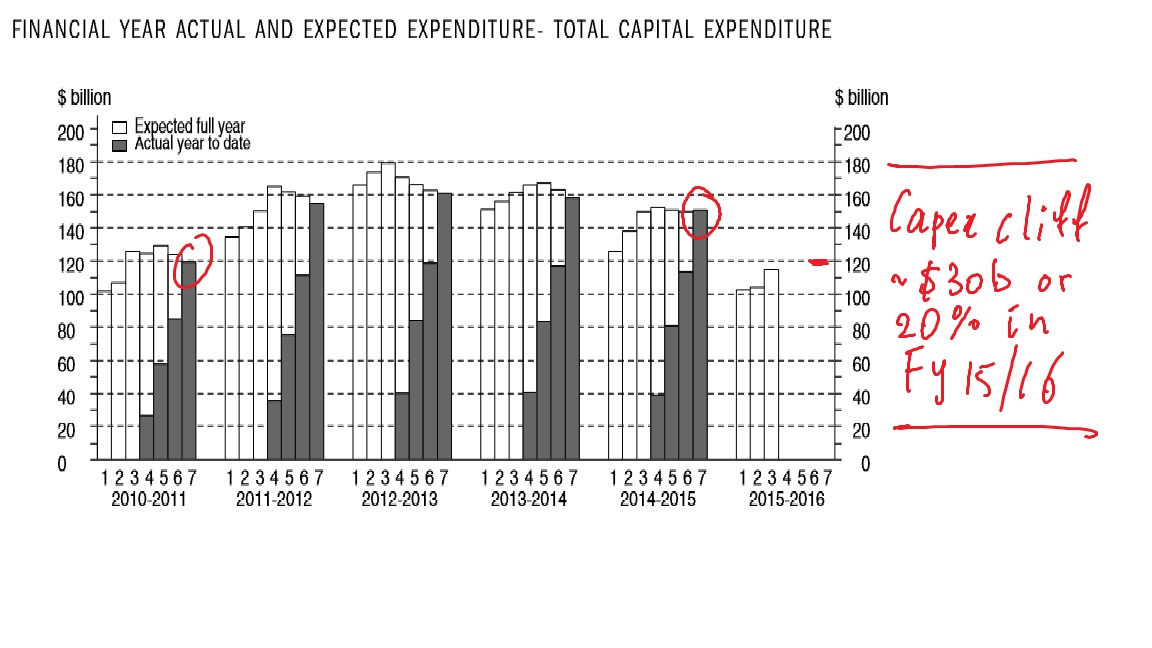

Fischer offers an innovative means of lifting the neutral rate and thus easing the constraints imposed by the zero lower bound; an expansionary fiscal policy designed to improve the stock of public infrastructure. Presumably he is implying that the social rates of return of such public investments would exceed the required rates of return.

Environment conducive to continued strong returns from listed infrastructure assets

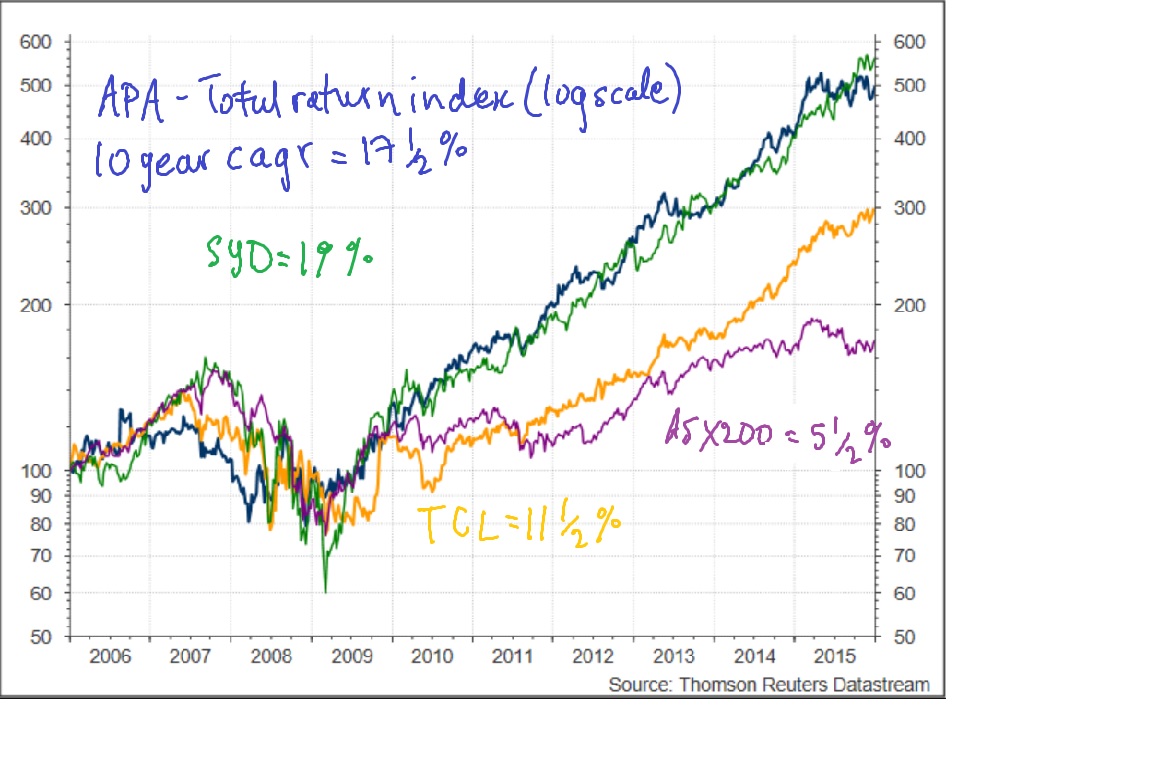

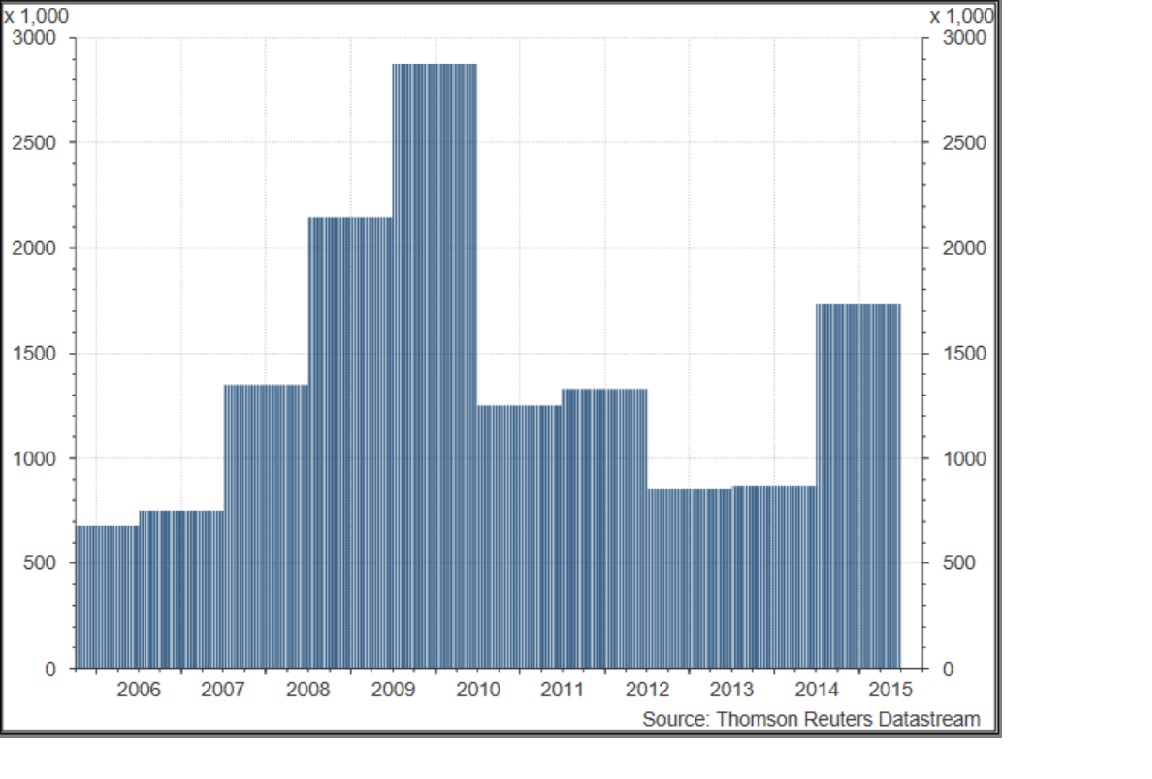

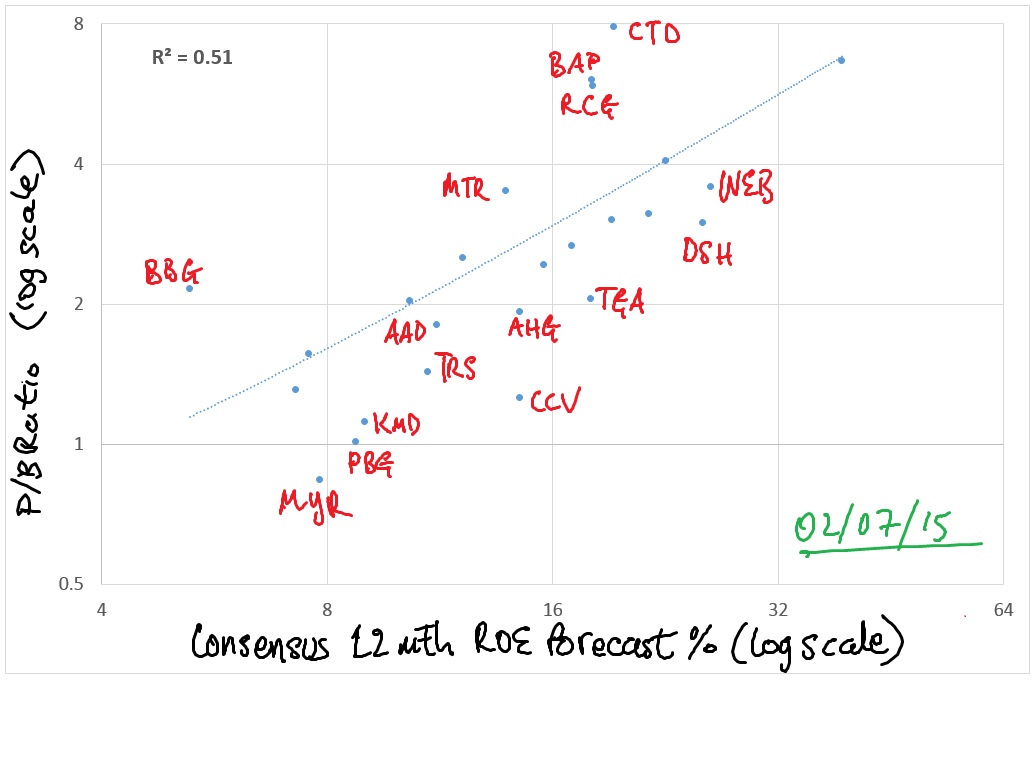

Infrastructure assets have been amongst the best performing sectors on the ASX over the past decade. Sydney Airport has yielded an accumulated return of 19% over this period, while gas line operator APA has produced a return of 17.5%, and toll-road operator has delivered a return of 11.5%, well above the ASX200 return of 5.5% (see chart).

Large depreciation charges for these stocks depress reported earnings, thus rendering standard earnings multiples meaningless as valuation yardsticks. But the strong performance of the sector has lifted free cash flow multiples to record highs. Nonetheless, if Fischer is right that the saving-investment imbalance is expected to persist and hold down the neutral rate of interest for the policy relevant future, then the new policy normal of low and slow should provide an environment conducive to continued strong returns from listed infrastructure stocks.

Concluding remarks

In summary, I expect that investors will continue to pay a premium for the earnings certainty and long duration that infrastructure assets offer, a desirable attribute for sovereign wealth funds and pension funds with a long investment horizon seeking assets that match the long duration profile of their liabilities.

Of course, the strong appetite from this clientele for low risk assets offering some growth comes with a sting in the tail. The higher prices for these assets point to lower expected future returns. Based on Fischer and Brainard's assessment of the slow process of policy normalisation, this dynamic has some way to play out. Against the backdrop of the new policy normal of low and slow, investors should treat any price pull-back in the sector as a buying opportunity.