INFLATION TARGETING: RIP?

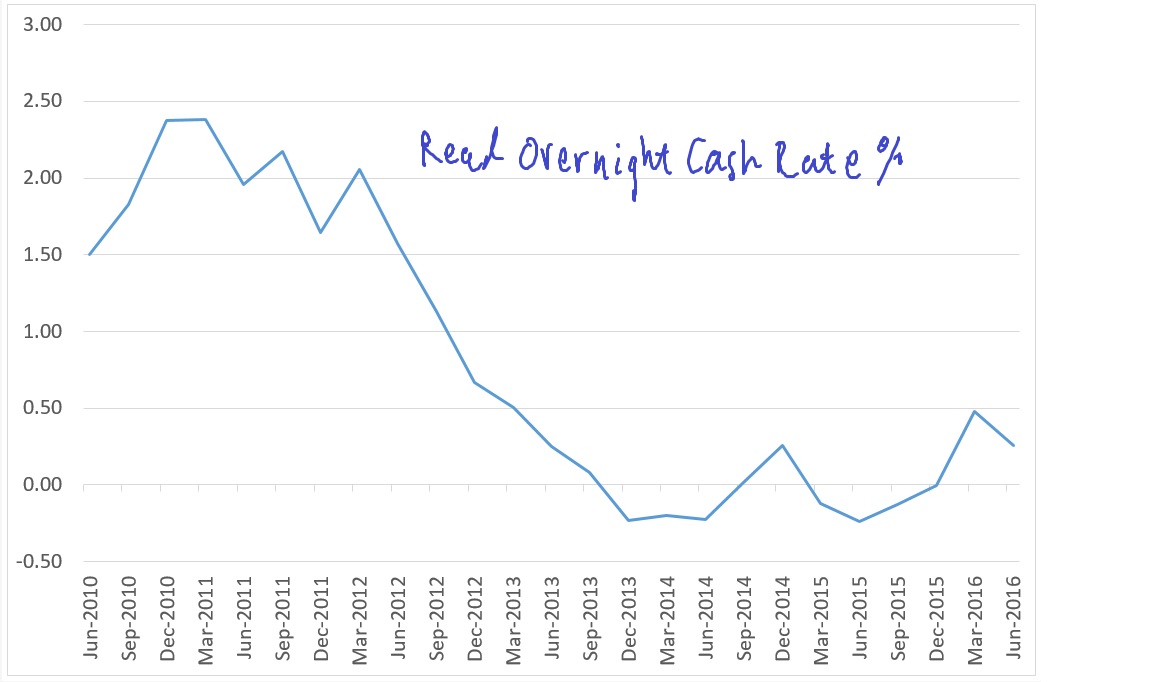

/Interbank Cash Rate Futures point to a 65% probability that the RBA will cut the Overnight Cash Rate (OCR) by 25 basis points to 1.5% at the RBA Board's August meeting. The implied probability has hovered around this level for most of July, both preceding and following the June quarter CPI which confirmed that underlying inflation remains at 1.5% yoy, well below the bottom of the RBA’s target band of 2-3%. Real rates have effectively lifted in the first half of CY2016, with the 25 basis point cut to the OCR in May only partially offsetting the plus 50 basis point decline in underlying inflation (see chart).

Evidente is cautious about using real or inflation adjusted rates as a proxy for the stance of monetary policy. Nonetheless, over a longer sweep, the drop in underlying inflation in the past year has lifted the real OCR to its highest level in three years (see chart).

An alternative to inflation targeting

Of greater concern is that the underlying price index has undershot the mid-point of the target range since global commodity prices peaked five years ago. The divergence has grown considerably since early 2015, with the price level now 1.7% below the RBA’s target (see chart). The problem with inflation targeting is that it discounts undershoots or overshoots that might have occurred more than a year earlier. The key benefit of price level targeting is that it retains this memory such that the RBA would need to deliver more aggressive stimulus to not just hit inflation of 2.5% but make up the lost 1.7%.

Regrettably, most of the misplaced public debate on monetary policy has questioned its efficacy at low rates of interest, thanks largely to Mr Stevens’ own comments. This is occurring at time when the US Federal Reserve is contemplating another rate hike and the Bank of Japan appears to be backing away from its commitment to tackle Japan's deflationary mindset. Clearly, there is a growing (and misplaced) crisis of confidence in the power of monetary policy to revive the psychology of risk taking.

Communications from the reluctant rate cutter confirm that the RBA is not ready to abandon inflation targeting in favour of price level targeting. Nonetheless, even within its own inflation targeting framework, Evidente believes that the central bank should deliver another rate cut this week of 25 basis points. With the Governor’s ten year term about to end in September, surely Mr Stevens will not want to leave a legacy of have tolerated a 50 basis point undershoot on the RBA’s inflation target?

Central bankers are a very cautious and conservative group, rightly focussed on risk management. But the growing evidence suggests that the two decade plus phenomenon of inflation targeting is rapidly approaching its expiry date. Evidente believes that price level targeting is better suited to address the powerful disinflationary forces associated with the global glut in saving.