Weekly impressions: Light at the end of the tunnel for corporate America?

/In a post from December 2015, Evidente drew on comments from Federal Reserve Governor Lael Brainard, suggesting that the normalisation of the federal funds rate was likely to follow a more gradual and shallower path thanpast tightening cycles. Overnight, Federal Reserve Chair, Ms Janet Yellen re-iterated that the new normal for policy normalisation would be low and slow, based on growing evidence that the neutral rate of interest was around zero; the level of the federal funds rate that is consistent with output growing close to its potential rate with full employment and stable inflation.

Echoing comments from Ms Brainard, Ms Yellen indicated that with the U.S. economy growing at a pace only modestly above potential while core inflation remains restrained, the nominal neutral rate may not be far above the nominal federal funds rate, even now. In real terms, the federal funds rate is around 125 basis points below zero. According to Ms Yellen, the current stance of policy is therefore consistent with output growth modestly outpacing potential and further improvements to the labour market. Ms Yellen remained silent on the future prospects for the neutral rate, but Ms Brainard has previously indicated that the neutral rate will remain low (possibly close to zero) for some time to come.

Ms Yellen noted that slow global growth and the significant appreciation of the US dollar since 2014 continue to weigh on 'business investment by limiting firms' expected sales, thereby reducing their demand for capital goods; partly as a result, recent indicators of capital spending and business sentiment have been lacklustre.' The slowdown in growth of expected sales is reflected in downgrades to consensus estimates for 12 month forward revenue per share for the S&P500 companies since late 2014 (see chart). This has coincided with a 20% appreciation of the Broad US dollar index, which clearly has undermined the competitiveness and profitability of exporters.

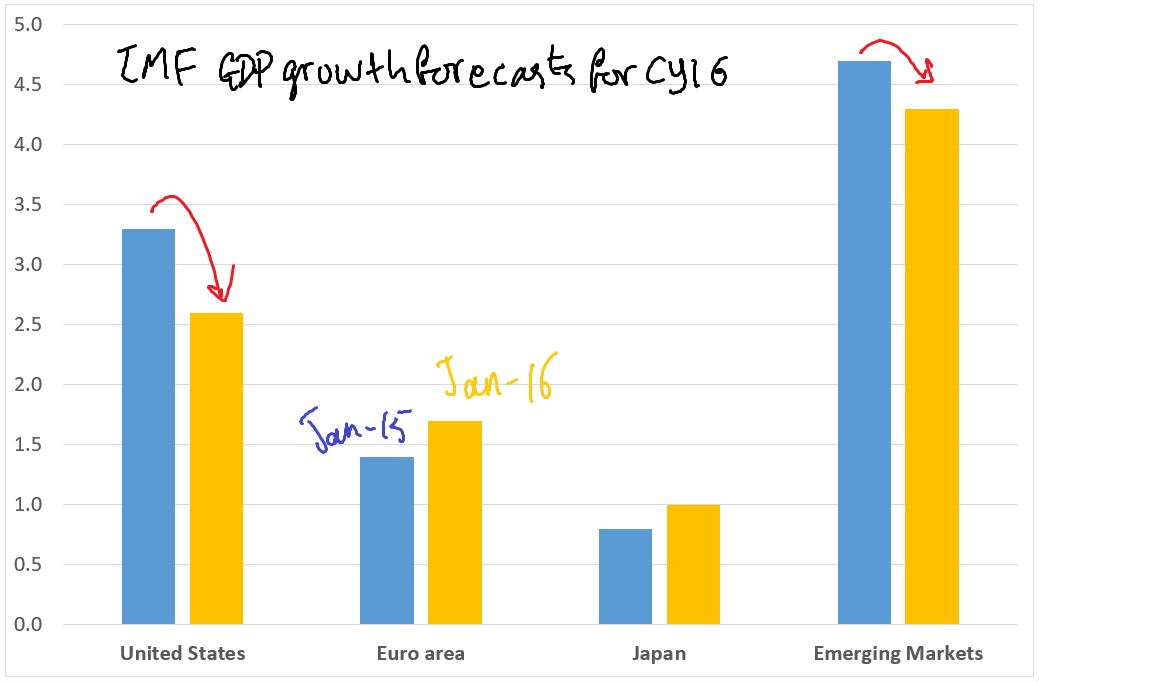

The IMF has downgraded its 2016 growth forecasts for Emerging Markets over the past year to 4.3% from 4.7%, but marginally revised up growth forecasts for Japan the Euro area. Across this comparator group, the 20% downgrade to the outlook for the United States to 2.6% from 3.3% has been more significant suggesting that global growth conditions have been a sideshow to depressed revenue conditions (see chart).

As Ms Yellen draws attention to, the scale and speed of US dollar appreciation has clearly crimped sales growth expectations. But if the IMF has downgraded the GDP outlook for the US more aggressively than other countries, what has underpinned the US dollar appreciation since 2014? The main culprit must be the expectations of lift-off in the federal funds rate over the course of late 2014 and 2015, particularly at time when currency and bond markets did not believe that the US economy was ready for policy tightening. It is therefore not entirely surprising that in the past month, renewed US dollar depreciation has been associated with more dovish communications from the Fed and the pushing out of further rate hikes following the publication of the dot plot of internal interest rate projections.

Monetary policy constrained, but not broken

In the launch report of Portfolio Construction Assist, Evidente suggested that the discount rate channel of monetary policy had been compromised because the lift in the expected equity risk premium had broadly offset the stimulatory impact of the exceptionally low returns from low risk assets. As a result, the ability to boost expected cash flows represents the key channel through which central banks can influence asset prices.

The downgrade to sales growth expectations in the past year points to an effective tightening of policy over this time, which has contributed to the pull-back in GDP growth expectations to around 2.5% for this year and next. If the Fed Chair and Governors continue to bang the drum on the new normal of low and slow policy normalisation, the key barometer of success will likely be a welcome and much needed improvement to corporate America's revenue environment.