Weekly Impressions

/The 5½% drop in the S&P500 in August was the biggest monthly fall since mid-2012, while the ASX200 declined by 7½%, its biggest fall since mid-2010. Annualised volatility in the S&P500 spiked to 27%, its highest level since November 2011. Nonetheless, the 6 month moving average of volatility of 14% remains broadly in line with historical trends over the sweep of the past 45 years (see chart).

Positive surprise on 2Q GDP, but growth remains stalled

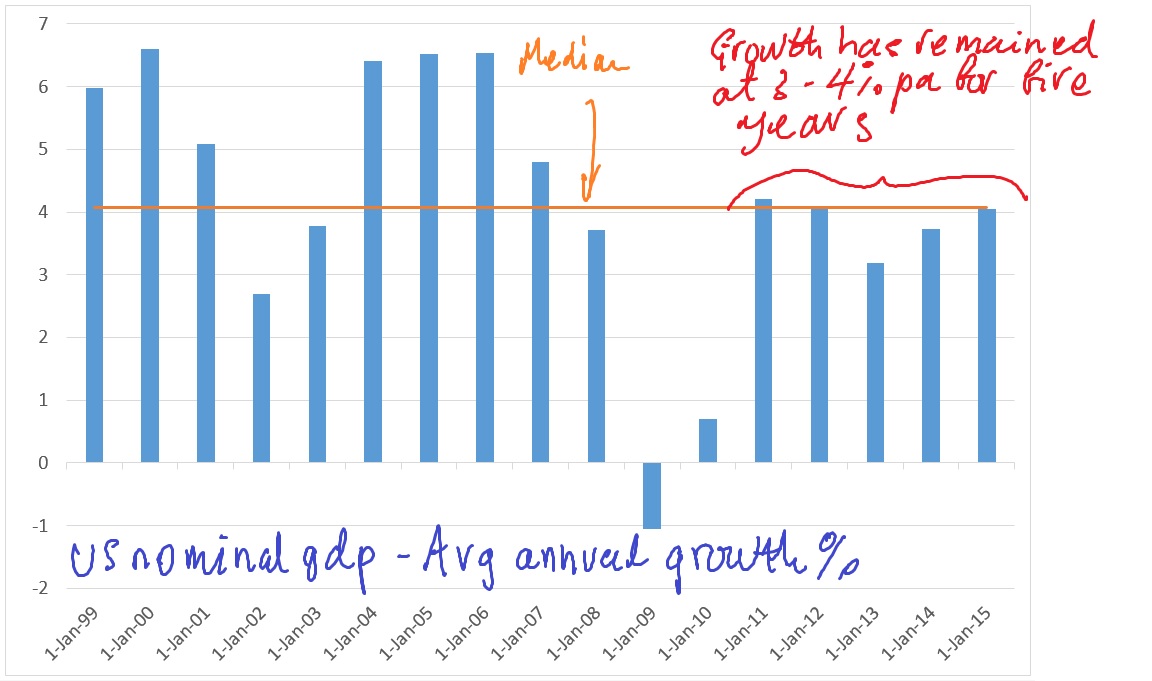

The data flow from the United States was surprisingly upbeat. The second estimate for real GDP showed a 3.7% (annualised) lift in the June quarter, up from the advance estimate of 2.3% and well above the March quarter outcome of 0.6%. This lifted average annual growth in nominal GDP (the current value of GDP) to 4% in 2014/15. But nominal GDP growth has stalled for the past five years at 3-4%pa (see chart).

The growth stall might help to explain why animal spirits in the corporate sector have remained dormant because nominal GDP is a more robust guide to business and consumer sentiment than real GDP. After all, businesses and households do not earn inflation adjusted cash flows.

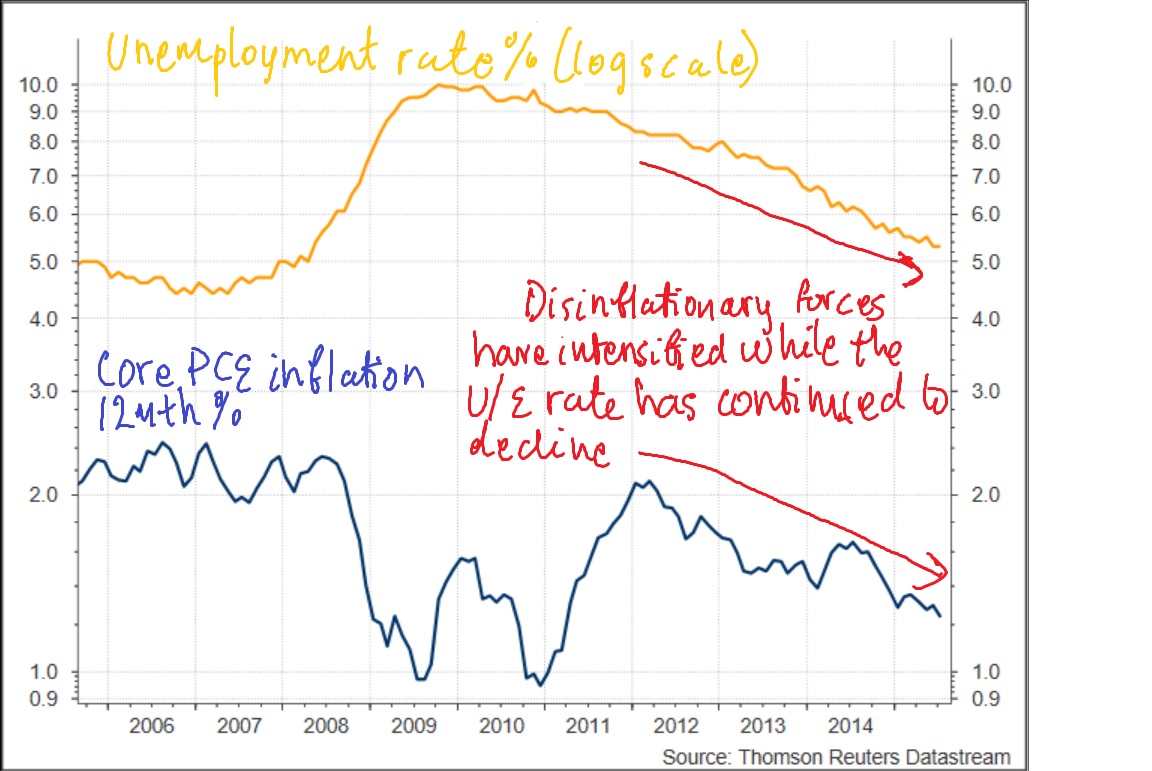

The US Federal Reserve’s unwillingness to combat disinflationary forces has contributed to the growth stall. The core personal & consumption expenditure (PCE) price index (which excludes food & energy items) is only 1.3% higher than its level a year ago. No doubt, the Fed remains puzzled that the disinflation of the past four years has emerged at a time when the unemployment rate has declined by more than 300 basis points (see chart). So much for a ‘tighter’ labour market contributing to higher inflation.

The apparent breakdown in the traditional inverse relationship between unemployment and inflation has been reflected in a flattening of the Phillips curve since the financial crisis, confirming that core inflation has become less responsive to changes in the unemployment rate (see chart). The flatter slope reflects 1) the fact that the unemployment rate has become a less reliable barometer for labour market conditions due to structurally lower labour force participation; and 2) inflation expectations remain well anchored.

Evidente has previously suggested that the flatter Phillips curve means that further cyclical improvement in the labour market might not lead to inflation moving back towards the Federal Reserve's 2% objective, giving the central bank scope to remain patient in it approach to normalising monetary policy (see blog post from 6th April 2015). But it appears that the Yellen Fed’s patience with its zero interest rate policy (ZIRP) is wearing thin, with the Fed flagging an imminent start to the normalisation of the Federal Funds rate.

Market volatility to remain high until the Fed clearly enunciates its goal

I and many others remain puzzled by the Yellen Fed’s approach because it is not clear what the Fed is seeking to achieve. Investors continue to be unnerved by the Fed’s willingness to tighten monetary policy at a time when inflation continues to undershoot its 2% target. US breakeven (TIPS implied) inflation expectations have fallen to 1.6%, their lowest level since 2010, wages growth is running at 2%pa and as cited above, core PCE inflation is running at below 1.5%pa. Financial market volatility will remain high until the Federal Reserve more clearly enunciates the goals of monetary policy and why it remains indifferent to achieving its inflation target

Australia's capex cliff to keep pressure on the RBA to ease policy again

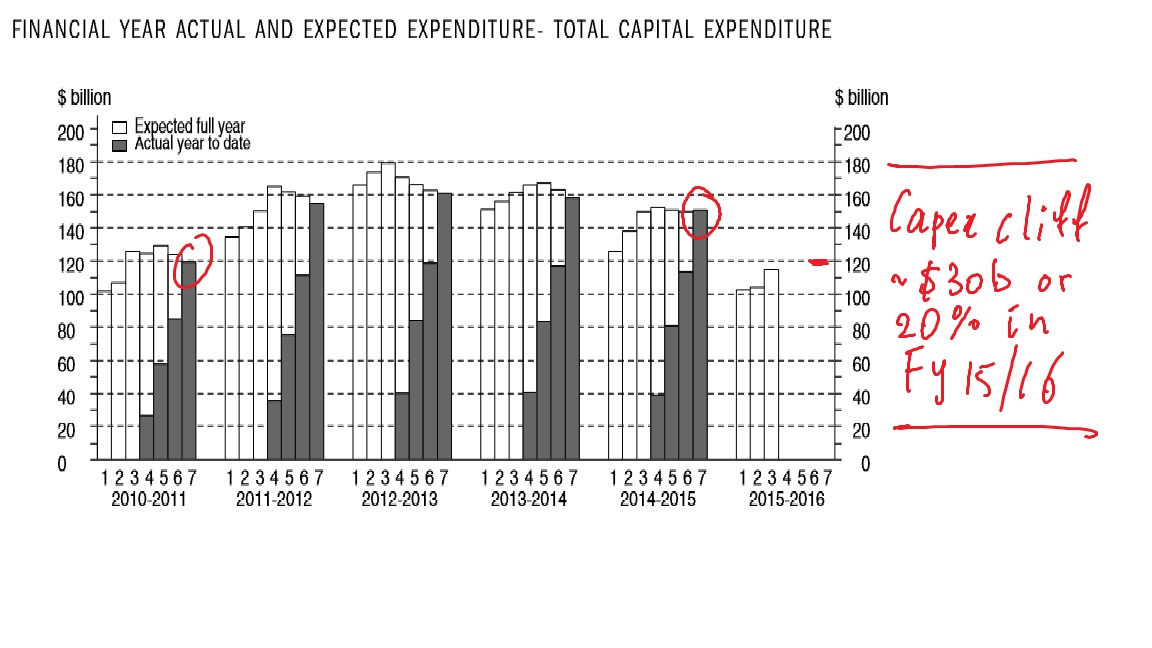

In Australia, the poor June quarter capex survey went under the radar due to the reporting season and elevated market volatility. The survey represents unambiguously bad news for the outlook, confirming that the economy is on the precipice of a $30 billion capex cliff, which would amount to a 20% slump (see chart). The long and drawn out transition from mining to non-mining capex continues to weigh on growth and frustrate the RBA. In my view, the re-balancing of growth will need an assist from further monetary stimulus

Woolworths – New hierarchy will need to re-focus on supermarkets

As far as reporting season, there were few big earnings surprises amongst the big cap stocks during the week. The news flow focussed on the drop in after tax net profit for Woolworths and the announcement of Mr Gordon Cairns as new Chairman. Masters continues to bleed money, and results at discount retail chain BIG W remain disappointing. The first step for Mr Cairns will be to find a replacement for outgoing CEO Mr Grant O’Brien. And the first step for the new CEO should be to divest the Masters and BIG W businesses, and re-focus Woolworths on its core competitive advantage of supermarkets where margins remain under pressure.

Postscript: After I had completed this post, Vice Chairman Stanley Fischer spoke at the annual Jackson Hole symposium, and attributed the low inflation in the United States in recent years to: US dollar appreciation, fall in commodity prices and stable inflation expectations. He said that the Fed would likely need to proceed cautiously in normalising the stance of monetary policy (read: don't expect rapid fire rate hikes) but in a clear signal that lift-off is imminent, added that the Fed should not wait until inflation is back to 2% before tightening. These comments will only add to the market's confusion regarding the Fed's indifference to its inflation target.