A new narrative for the Australian dollar (Update)

/Two months ago, Evidente published a detailed report which suggested that contrary to the RBA's view that the currency remained over-valued, the Australian dollar was trading modestly below fair value of 80 US cents. After what had been a strong period of out-performance from US dollar earners, I concluded that without the tailwind of A$ over-valuation - which prevailed through most of 2014 - their returns in the near term would be capped. In this post, I provide an update of Evidente's A$ model and show that recent currency appreciation has been associated with under-performance from US$ earners.

Since the publication of the report on March 20th, the Australian dollar has confounded the expectations of futures markets, most market economists and the RBA, appreciating by around 3% against the US dollar. The RBA's communications have become even more pointed about the persistently high A$. In the statement accompanying the recent decision to cut the official interest rate by 25 basis points to 2%, the RBA Governor said that 'further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices.' The A$ has not followed the RBA script, depreciating against the US$ by only 30% from the peak in global commodity prices in 2011, well below the 50% fall in the RBA's Commodity Price Index (in US$ terms).

Mr Stevens is right to highlight that the A$ deprecation has been modest compared to the decline in commodity prices in the past four years. But over the sweep of the post float period, the A$ typically has not moved lock in step with swings in commodity prices. For instance, the appreciation through the mid-2000s was muted given the size magnitude of the upswing in commodity prices. In the five years to mid-2008, the A$ had appreciated by 40% against the US$, but the RBA’s Commodity Price index more than tripled in US$ terms over this period (see chart). During this time, the RBA did not acknowledge publicly that the A$ remained substantially below its fundamental value.

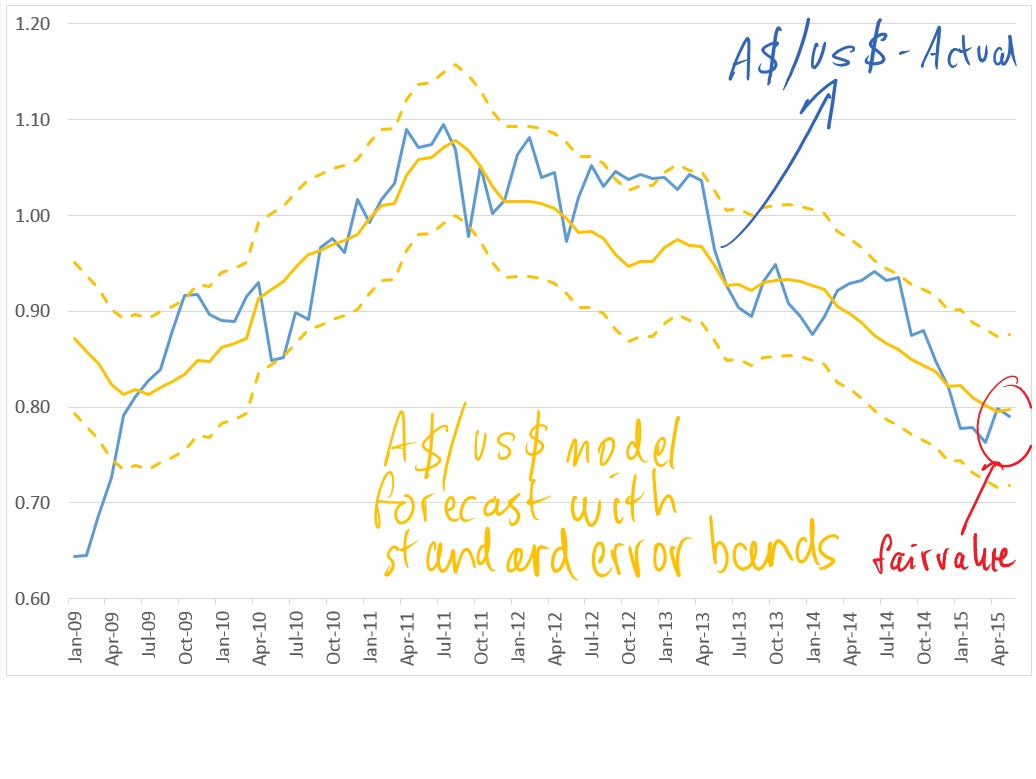

Despite the modest lift in commodity prices in recent months, and the further easing of monetary policy in Australia in early May, Evidente's econometric model of the A$ points to fair value of around 79-80 US cents. The key innovation of the model is that it utilises an interest rate differential variable based on a negative or shadow Federal Funds rate, developed by Leo Krippner at the RBNZ. The modest under-valuation that prevailed at the time of publication of the original report has now dissipated and the A$ is trading in line with fair value (see chart).

After what had been an extraordinarily strong period of returns from US$ earners in the six months to April, the renewed A$ appreciation has been associated with under-performance from this basket in recent months (see chart).

The table below provides the list of big-cap US dollar earners. The basket is trading on a median 12 mth forward PE of 20x, which represents a 25% premium to the median estimate for the ASX100 and is slightly higher than historical norms. The basket trades on a premium because offshore earners exhibit significantly higher long-term growth expectations and lower betas than the broader market. Their low betas arise from the predominantly defensive nature of their cash flows and business models. The three stocks that suffer from the highest level of analyst bearishness remain Cochlear, Treasury Wine Estates and Westfield, which each attract less than 20% of buy recommendations from sell-side analysts.