Further rate cuts from the RBA no saviour for domestic cyclicals

/Although still in its infancy, 2015 has so far been a frenetic one for central banks around the world, in what has been a series of synchronised (but not co-ordinated) monetary easings. Central banks in Switzerland, Denmark, Turkey, Canada and Peru have cut their official interest rates in recent weeks, and at the time of writing, the ECB is expected to extend and expand its program of quantitative easing at its meeting on January 22nd.

The Bank of Canada’s (BOC) decision on Wednesday to cut its key lending rate by 25 basis points to 0.75% has lifted investors’ expectations of a rate cut at the RBA’s February board meeting. Interbank cash rate futures now point to a 30% probability that the RBA cuts rates by 25 bps in February, up from 20% a day earlier.

In this post, I discuss the implications of the BOC’s decision for the RBA’s policy deliberations, suggest that the RBA should reduce the cash rate to 2% by June and undertake quantitative analysis of previous easing cycles which suggests that domestic cyclicals are unlikely to benefit from rate cuts.

How shocking is the terms of trade shock?

The BOC cited the precipitous drop in the price of crude oil as the key reason behind its decision to ease policy for the first time since 2009. As a major oil exporter – crude oil accounts for 15% of the country’s export basket – the BOC said that the negative terms of trade shock will have an adverse impact on growth in incomes, wealth, and domestic demand, and reduce inflation pressures.

The BOC highlights the multiplier effects of the lower oil price on investment in oil extraction, which accounts for 3% of GDP. More generally, the oil and gas sector makes up almost one third of Canada’s business investment. Against this backdrop, the central bank justified the rate cut as providing insurance against these risks materialising.

Both Canada and Australia are small open economies that are commodity exporters. But the impact of the oil price decline on the two economies is markedly different because while Canada is a net oil exporter, Australia is a net importer of oil. So what amounts to a negative terms of trade shock for net oil producers like Canada, is a positive shock for net consumers like Australia (albeit a smaller one).

Although crude oil accounts for 4% of Australia’s export basket, oil imports exceeded exports by $25 billion in 2014, which translates into oil trade deficit of 1.5% of GDP (see chart). A 50% drop in the price of crude oil therefore equates to a positive terms of trade shock of 0.75% of nominal GDP.

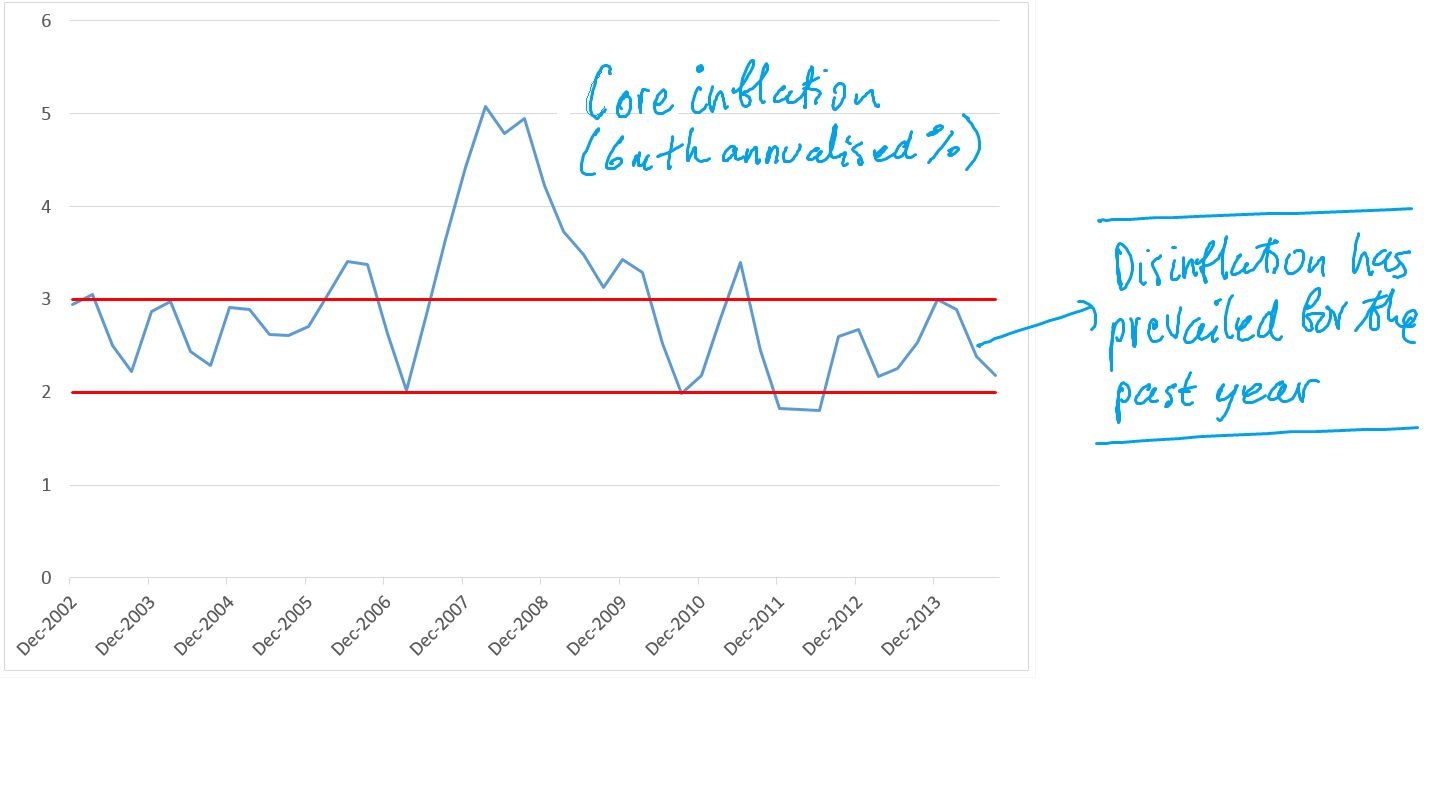

For the RBA then, the lower oil price imparts a stimulus to nominal GDP. But like Canada, the lower oil price has arrived at a time when core inflation pressures have been trending lower and inflation expectations remain well anchored (see chart).

Oil, inflation and the RBA’s positive narrative

The lower oil price is not the reason why the RBA should ease policy, particularly as a lift in expected global oil production has underpinned the drop in price. The key reasons have been present for some time. Australia has suffered a significant negative terms of trade shock since global iron ore and coal prices peaked in 2011.

During this time, the terms of trade has declined by around 30%, which has underpinned the fact that Australia has remained stuck in a nominal recession for three years. In all fairness to the RBA, it cannot control commodity prices, but it could have taken a leaf out of the BOC’s playbook and cut interest rates more aggressively as insurance against growing unemployment.

The sharp decline in the oil price however, provides the RBA with a positive narrative to cut interest rates while downplaying the anaemic state of the nominal economy. In a blog post on December 12th (Money’s too tight to mention) following an interview from the RBA Governor to the Fairfax press, I suggested that Mr Stevens had started to lay the groundwork for more policy stimulus, based on the prospect that a lower oil price would further reduce inflation pressures to below the RBA’s target range of 2-3%.

I argued that the inflation outlook therefore would form an integral part of the RBA’s positive narrative, so the most likely timing of the next rate cut would be February, a week following the release of what is likely to be a benign CPI print for the December quarter. Expect another rate cut to follow in at the May board meeting, a week following the release of the March quarter CPI in late April.

Rate cuts no saviour for domestic cyclicals

I have undertaken a quantitative analysis of the performance of domestic cyclicals based on the current easing cycle stretching back to late 2011. Specifically, I track the performance of the media, building materials and discretionary retail sectors around the two last episodes of rate cuts in late 2011 and through most of 2012/13. Rather than benchmark against the performance of the market, I benchmark domestic cyclicals against domestic defensives (split out into banks and non-bank defensives).

Domestic cyclicals did not outperform in late 2011, at a time when the central bank cut interest rates by a cumulative 50 basis points. In fact, the domestic defensives outperformed strongly during that time. The returns of domestic cyclicals in the second period of policy easing in 2012/13 was mixed. Discretionary retail performed strongly, but both media and building materials underperformed the banks and non-bank domestic defensives (charts are available on request).

The chart below shows the performance of domestic cyclicals in recent months, as the market has gradually factored in another rate cut by May 2015. The performance of interest sensitive sectors has been mixed, with building materials flying, but discretionary retail and media lagging.

The key caveat to the empirical findings is that the analysis is based only on two episodes of rate cuts in the current easing cycle, and thus is vulnerable to the charge of mindless data mining. But I believe the way the RBA has conducted monetary policy this cycle is markedly different to past cycles.

And therein lies the answer to the puzzle of why interest-sensitive sectors haven’t performed better around RBA rate cuts in the current easing cycle. Perhaps paradoxically, most of the potency of monetary policy lies in the expectations the central bank creates about future monetary policy; and in this cycle the RBA has been far more ambivalent about stimulating growth than it has been in previous cycles.

This has manifested both in terms of the quantum and timing of rate cuts, and in the RBA's language. The RBA's timidity reflects its concerns around moral hazard, stoking a bubble in property and rapid growth in investor housing lending. Accordingly, rate cuts to date have had little effect in reviving animal spirits in the corporate and household sectors.

To the extent that further rate cuts are associated with the RBA reminding investors of those concerns, this will blunt the announcement effect on interest sensitive sectors, and will do little to revive entrepreneurial risk taking. Perhaps this time is different; after all, the prospect of rate cuts in Australia is occurring against the backdrop of synchronised monetary easing globally. But my bet is that this time won’t be different.

Key action point

If the RBA cuts rates twice in 1H15 (as I expect it will in February and May, immediately after the 4q and 1q CPI prints to promote a positive narrative for policy easing), no need to be overweight domestic cyclicals.